Risks and Opportunities of Climate Change

Climate Governance

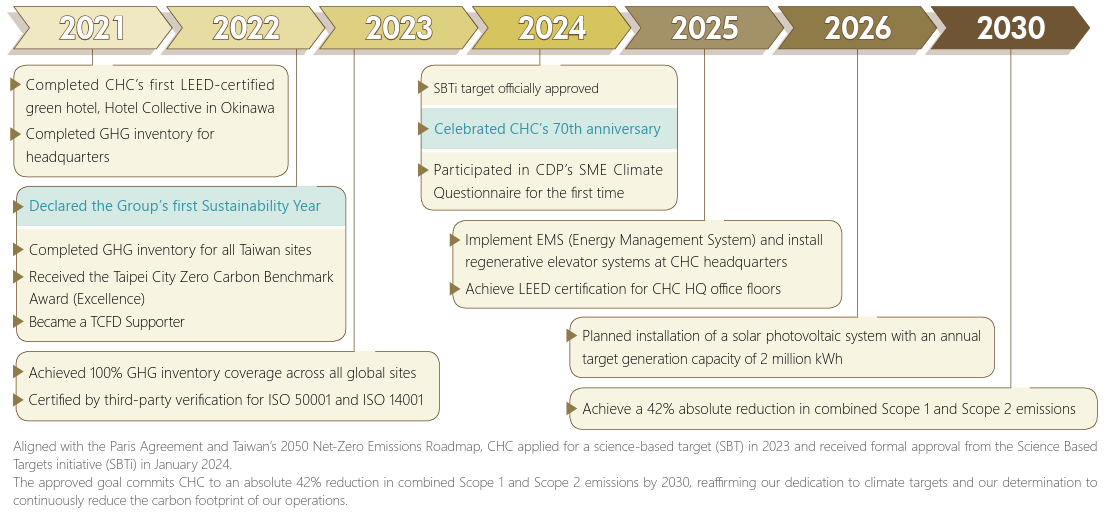

Climate Governance and Carbon Reduction Milestones

In response to global climate change, CHC firmly believes that corporations must play an active role in climate action and reduce greenhouse gas emissions. CHC completed its 3rd consecutive year of full-scope GHG inventory across all domestic and overseas locations and continues to advance energy-saving and decarbonization initiatives to move toward a low-carbon, net-zero future.

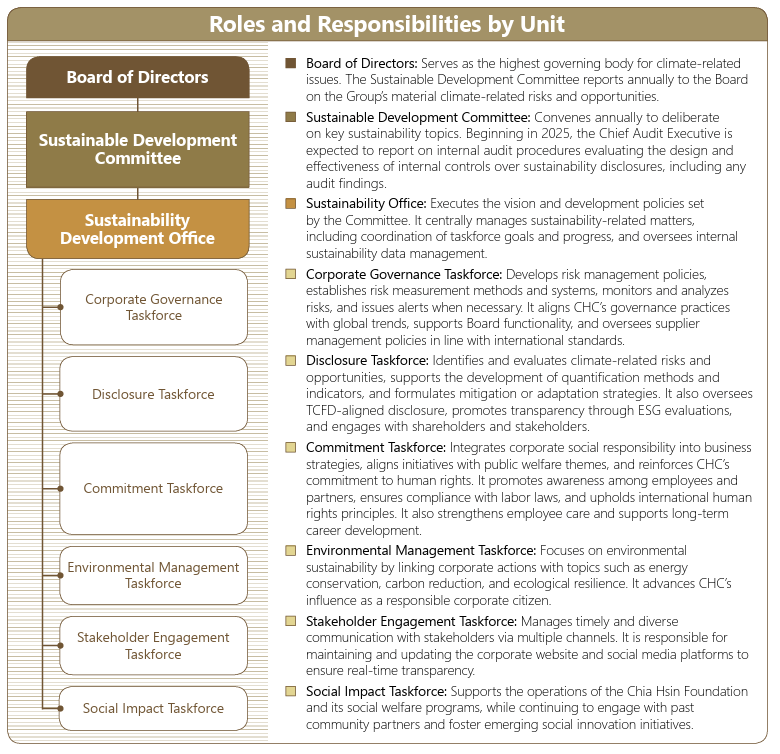

Climate Issue Management Structure

The Board of Directors serves as CHC’s highest governing body for climate-related issues. To enhance climate oversight, the Board has established the Sustainable Development Committee, which delegates authority to members with professional expertise in corporate sustainability. The Committee is chaired by Chairman Jason, K. L. Chang, with President Elizabeth Wang serving as Chief Sustainability Officer (CSO). Supporting the Committee is the Sustainability Development Office, led by the Office’s Manager acting as Executive Secretary. The Committee is responsible for reviewing climate strategies and targets, monitoring execution progress, and reporting to the Board at least once per year. Sustainability Development Office is the core unit for executing and advancing CHC’s sustainability strategies. It is overseen by the CSO and, in 2024, restructured its internal divisions based on functional responsibilities. The Office currently comprises six taskforces, each composed of personnel from operating units and relevant departments: 1. Corporate Governance Taskforce 2. Disclosure Taskforce 3. Commitment Taskforce 4. Environmental Management Taskforce 5. Stakeholder Engagement Taskforce 6. Social Impact Taskforce The Office convenes regularly to implement, monitor, and manage sustainability goals. In 2024, it held 5 meetings to ensure target alignment and performance tracking. CHC has also begun incorporating climate-related goals and performance into senior executive evaluations and compensation systems, reinforcing organizational accountability and ensuring that climate targets are effectively achieved.

Climate Action

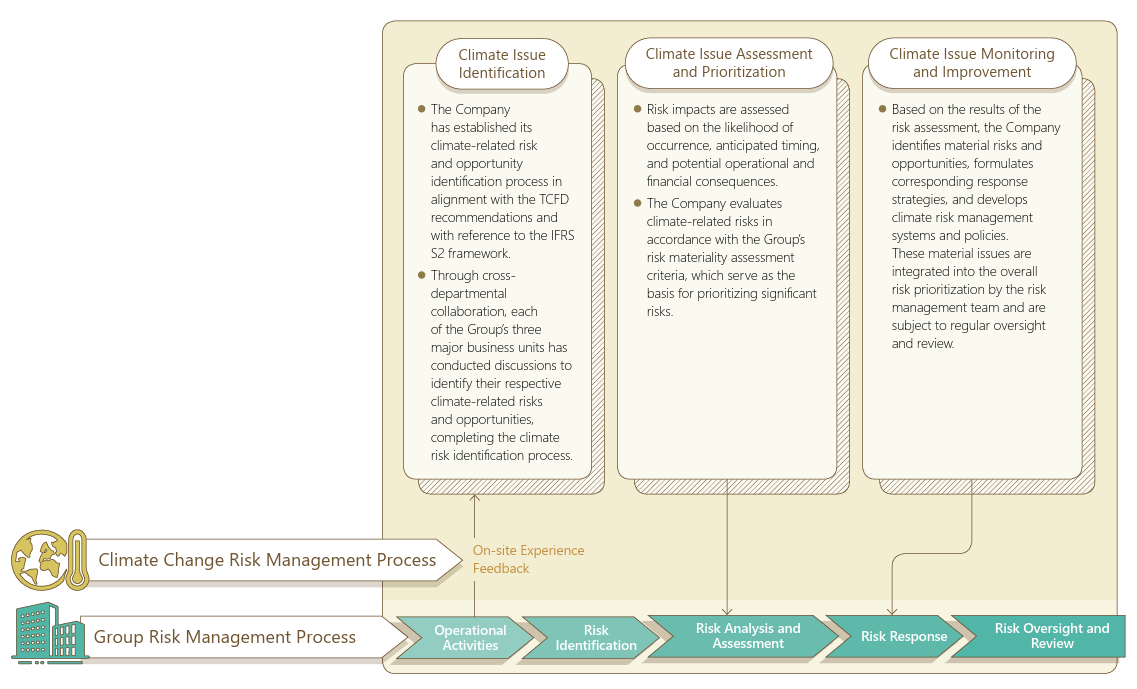

Climate Risk Management Framework and Mechanism

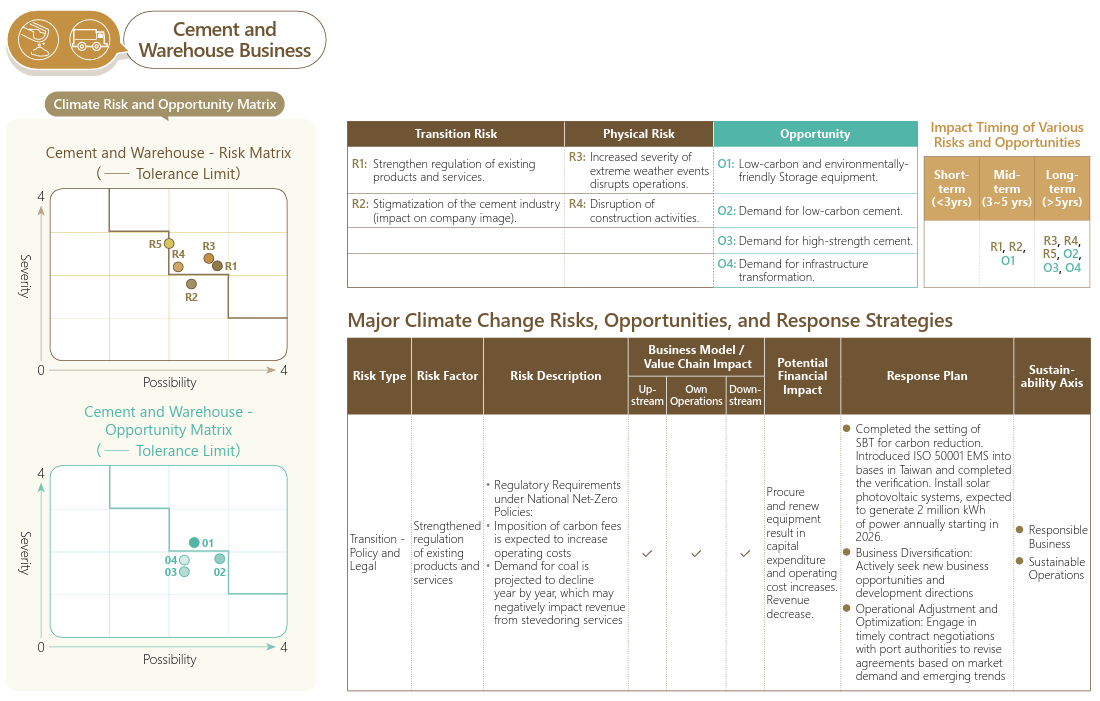

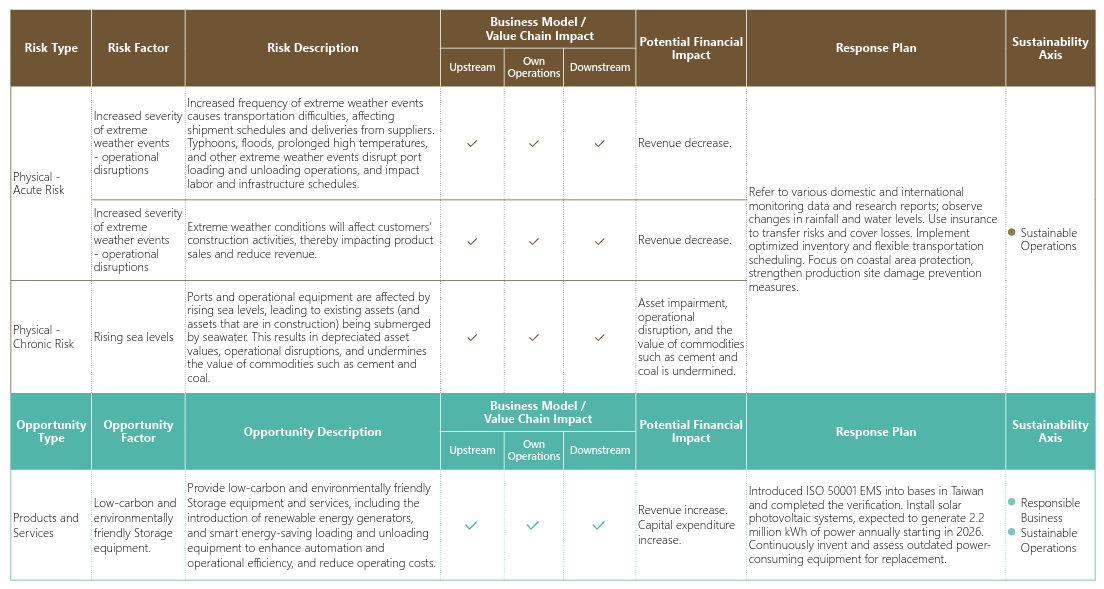

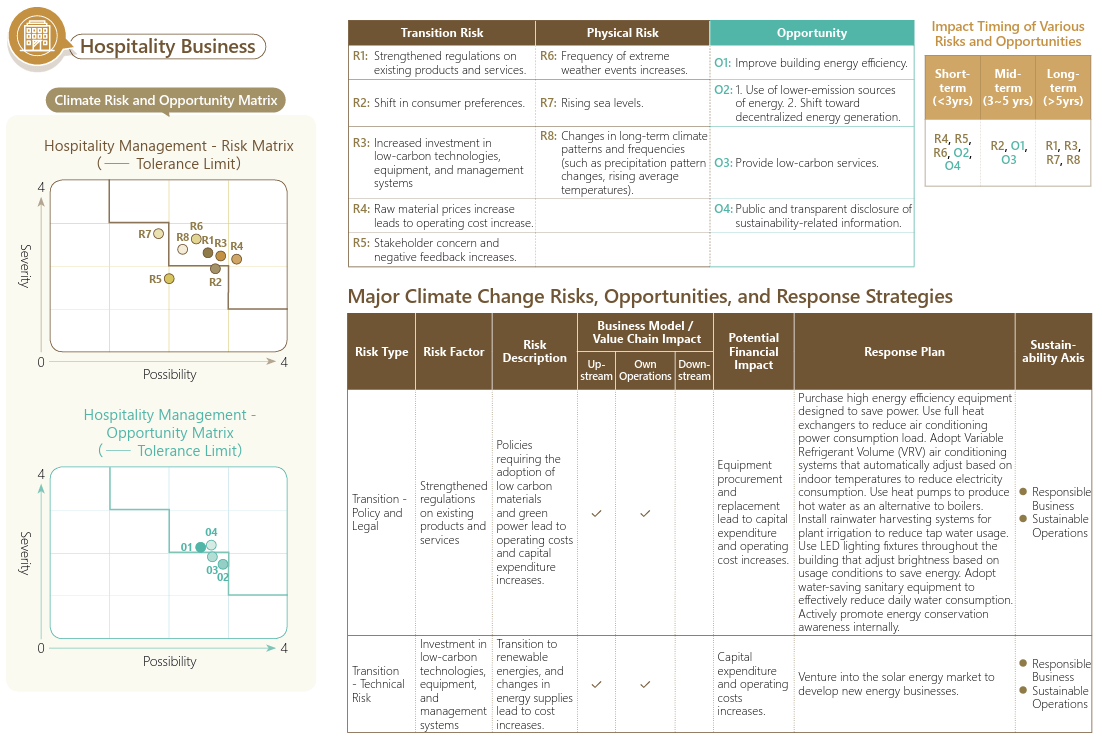

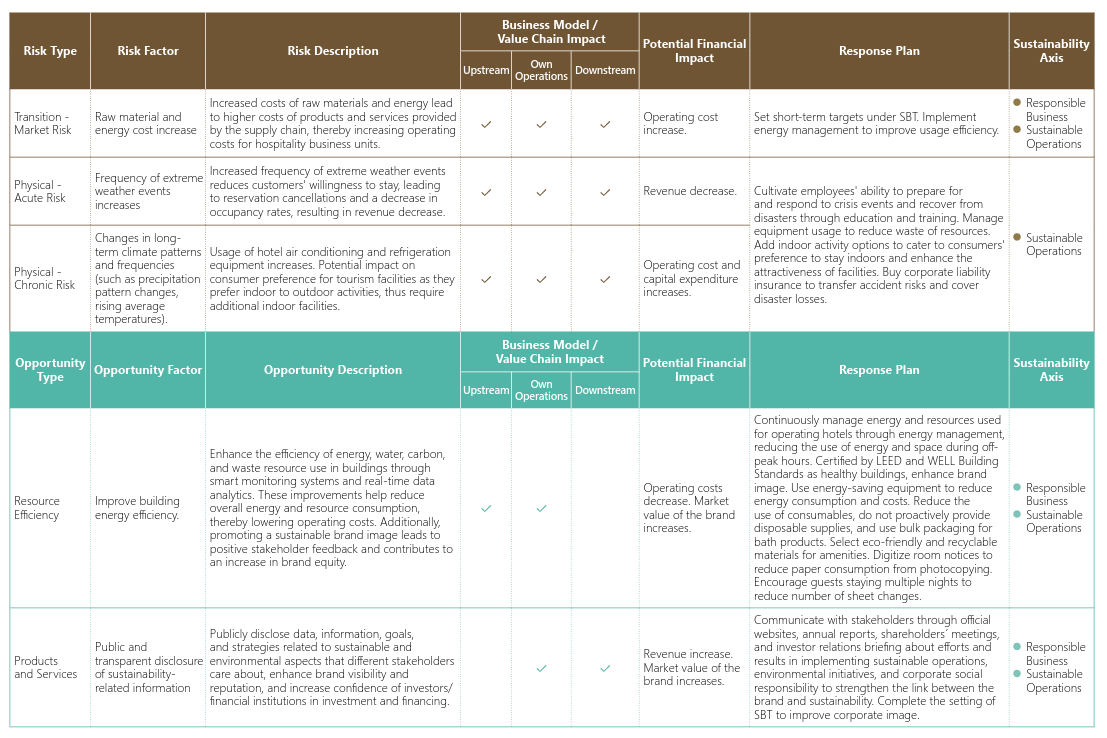

CHC conducts climate risk and opportunity assessments across its three core business sectors— Property Management, Cement and Warehousing and Hospitality. In alignment with evolving industry trends and regulatory developments, the Company regularly updates its material climate-related issues. A series of cross-departmental meetings are held to review and discuss climate risks. Once material risks are identified, their potential financial impacts are assessed, and corresponding mitigation strategies are formulated. In accordance with CHC’s internal risk materiality standards, both physical risks and transition risks identified by the Corporate Governance Taskforce are incorporated into the Company’s overall risk ranking system. Through coordinated communication and integration among the various taskforces under the Sustainability Office, CHC ensures a comprehensive risk assessment, response and oversight mechanism are in place across the Group.

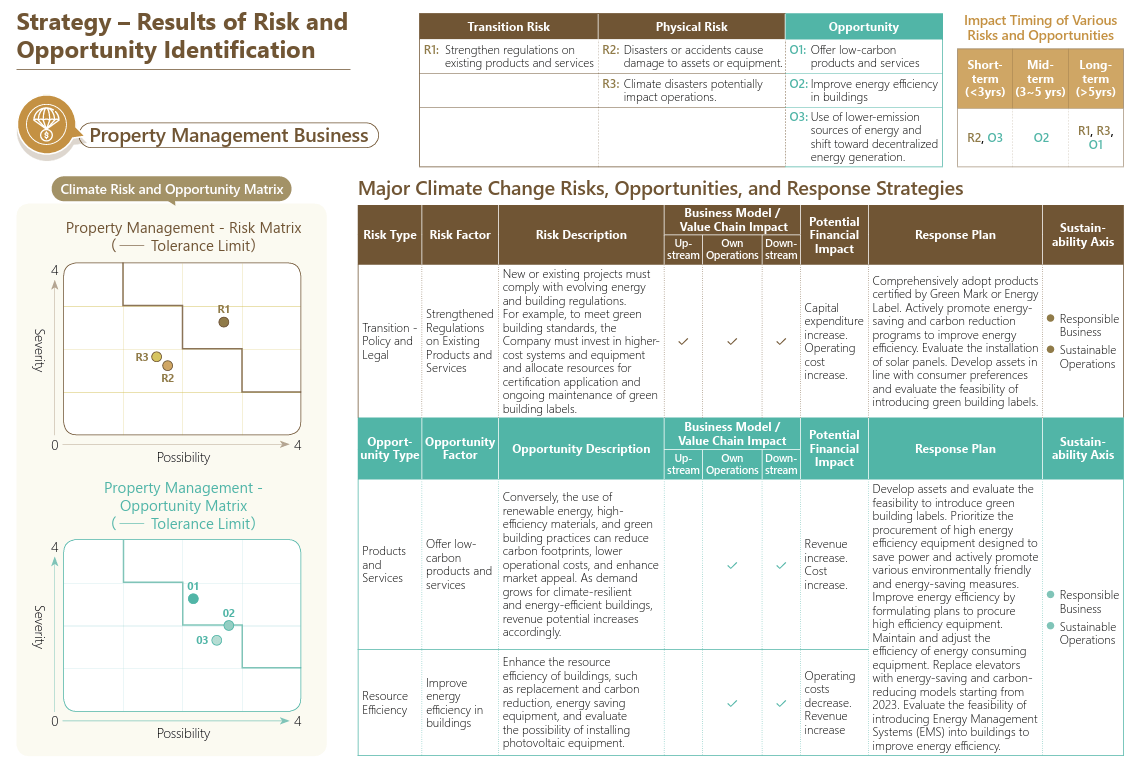

Strategy – Results of Risk and Opportunity Identification

Scenario Analysis

In accordance with the recommendations of the TCFD, CHC has conducted a climate risk scenario analysis to assess the potential impacts of increased frequency of extreme weather events and tightened regulations on existing products and services.

Physical risk

Scenario of increased frequency of extreme weather events

The Group evaluated the financial impacts caused by increased frequency of extreme weather events such as typhoons, floods, and torrential rain. Based on the analysis results, the Group appropriately planned and implemented adaptation policies to mitigate risks, enhancing climate resilience and adaptive capacity.

Reference: IPCC 6th Assessment Report (AR6)

| Scenario Setting | Detail |

| Temperature Scenario | SSP5-8.5 (temperature rise of 4.0°C) |

| Impact Period | Short term (< 3 years), analysis based on 2025 |

| Affected Parties | Upstream, own operations and downstream |

| Risk Topic | Increased frequency of extreme weather events |

| Operational Impact | Reduced customer willingness to stay, leading to reservation cancellations and lower occupancy rates |

| Expected Financial Impact | Revenue decrease. The estimated impact on projected FY2025 revenue is approximately NT$3.55 million, accounting for 0.48% of the expected annual revenue. |

| Expected Management Costs | The existing management cost to maintain operations is approximately NT$1.71 million, accounting for 0.23% of the projected FY2025 revenue. |

| Estimated Financial Impact and Management Costs as a Percentage of FY2025 Revenue | 0.71% |

| Response Strategy | Please refer to “Hospitality – Major Climate Change Risks, Opportunities, and Response Strategies” for details. |

Transition risk

Strengthen regulation of existing products and services

In response to the national net-zero emission goal, some regulations or clients may require the Group to provide low-carbon warehousing, loading, unloading, and sales services, resulting in cost increases.

Reference: IPCC 6th Assessment Report (AR6)

| Scenario Setting | Detail |

| Temperature Scenario | SSP1-2.6 (temperature rise of 1.5°C). Taiwan achieves NDC goals. |

| Impact Period | Mid-term (3~5 yrs). Analysis is based on 2030 ( Note 1 ). |

| Affected Parties | Own operations |

| Risk Topic | Strengthen regulation of existing products and services |

| Operational Impact | The government’s carbon management regulations require carbon fees. |

| Expected Financial Impact | Cost increase; it is estimated that by 2030, carbon fees will increase by approximately NT$720,000 to NT$9.65 million, accounting for about 0.005% to 0.069% of the sector’s projected revenue. |

| Expected Management Costs | To reduce carbon fee expenditures, the Company plans to invest in upgrading energy-saving equipment. From 2024 to 2025, the estimated management cost is approximately NT$4.2 million, accounting for about 0.302% of the sector’s projected revenue. |

| Accounting for % of the business unit’s estimated revenue in 2030 (Note 2) | 0.307% ~ 0.371% |

| Response Strategy | Please refer to “Cement – Major Climate Change Risks, Opportunities, and Response Strategies” for details. |

Note 1: The estimated data for 2028 cannot be obtained due to restrictions on the availability of external data, so the analysis is based on 2030.

Note 2: The estimation is based on two scenarios: SBT and BAU (Business As Usual).

Diversified Business Activities

In response to climate change, the diverse development of the high-carbon cement industry can disperse the impacts of climate change and strengthen climate change resilience.

• Increased market needs and revenue

• Improved competitiveness due to market transformation

• Enhanced operational resilience

Management guidelines

1. Business diversification disperses climate- related operational and investment risks, and is included in the Group's investment evaluation and risks management systems.

2. Conduct overall evaluations to reduce investments in industries with high GHG emissions and increase the Group's proportion of low-carbon, high-resilience products and services.

Entering New Markets

Climate change promotes discourse on low-carbon emission and environmental impacts, indirectly drives the demand for new hotels and care center services in relation to healthy buildings.

• Increased market needs and revenue

• Improved competitiveness due to market transformation

• Enhanced operational resilience

Management guidelines

1. Conduct overall evaluations to reduce investments in industries with high GHG emissions and increase the Group's proportion of low-carbon products or services.

2. Introduce ISO 14064 and ISO 50001 management systems into all of the Group's operations to promote energy and GHG emissions related goals for our products and services and secure a competitive foothold in emerging sustainable markets.

Change in Customer Preferences

The adoption of LEED and WELL building standards, IHG Green Engage systems, and products or services with low energy intensity in response to climate change improves competitiveness and corporate image, which in turn enables us to obtain building bulk-ratio or floor-area-ratio incentives from the government.

• Increased market needs and revenue

• Improved competitive edge

• Reduced operational costs

Management guidelines

1. The Group's ESG and environmental sustainability strategies are established by governance and top-level management while dedicated teams are responsible for promoting the sustainable transformation plans.

2. Promote ESG goals related to our products and services to enhance brand value and customer awareness.

3. Green buildings in Taiwan are entitled to building bulk- ratio or floor-area-ratio incentives depending on the certification category. Such bonuses help to reduce the cost of managing and running the building.

Industry and Regulatory Changes, Reduced Customer Demand

Given the country's net zero emissions target, relevant laws, regulations, and state-mandated restrictions on the use of coal,as well as carbon reduction trends, it is necessary for the company to provide low-carbon products and services, which reduces the company's business activities while raising operating costs and capital expenditures.

• Reduced demand of services

• Increased operational costs

Management guidelines

1. Assess the regulation and control trends of each business for incorporation into the Group's risks management system, for the timely monitoring and adjustment of the management system.

2. Introduce ISO 14064 and ISO 50001 management systems into all of the Group's operations and set energy and GHG-related policies and goals to reduce the energy and GHG intensity of our services.

3. Promote business diversity to disperse climate- related investment risks.

Low-carbon Products Replacing Current Products and Services

Competitors provide better low- carbon warehousing, sales services and accommodation services.

• Reduced demand of services

• Increased operational costs

Management guidelines

1. Introduce energy and GHG management systems, set GHG-related policies and targets at the initial development and design stage of new businesses, enabling them to become top choices in the low- carbon market of the future.

2. Realize energy management, save energy, and reduce carbon emissions in regular operations, so as to reduce the dependency on the use of energy.

Rising Sea Levels

In regards to storage and hotel-related assets located in coastal areas, the rise in sea level may affect their long-term operation and asset values.

• Asset impairment

• Increased operational costs

Management guidelines

1. Assess the physical climate risks of the assets in both our current and planned operations; formulate backup plans such as an emergency reporting procedure or alternative working locations during emergencies; and evaluate the needs for relocation and redesign.

2. Incorporate physical climate risks into the Group's risks management system for regular review and monitoring. For suppliers located in low terrains, identify the risks of breach of contract or material supply disruption and plan for backup suppliers and materials in advance.

3. Periodically evaluate insurance coverage for assets that are exposed to physical climate risks.

4. Consider foundation elevation and appropriateness of location in new construction plans.

Increase in the Severity of Extreme Weather

Extreme weather fluctuations affect business operations, products, services, and asset status, as well as increase the frequency of asset maintenance.

• Business disruptions

• Reduced demand of services

• Increased operational costs

Management guidelines

1. Assess the regulation and control trends of each business for incorporation into the Group's risks management system, for the timely monitoring and adjustment of the management system.

2. Introduce ISO 14064 and ISO 50001 management systems into all of the Group's operations and set energy and GHG-related policies and goals to reduce the energy and GHG intensity of our services.

3. Promote business diversity to disperse climate-related investment risks.

4. Adopt remote work or work from home plans to avoid the risk of business disruptions caused by extreme weather.

5. Regularly review asset status and reinforce repair and maintenance work to avoid concerns about operational safety.